Insight

Invest in the Future – Ireland, Europe’s Fintech Hub

Migrating to Ireland is becoming an increasingly attractive option for families, not only because of the quality-assured education system, but also the strong bounce-back in business, proving the economy’s robustness and agility. Ireland’s economic strength, coupled with its emerging focus on tech industries, offers many career opportunities for children as they look to the future.

In our previous blog Ireland’s Job Market – Which professional sectors are in high demand?, we introduced the country’s booming job market and its leading employment sectors. Our Marketing Director Jay Cheung recently spoke to Derek Kenny, Co-Founder and Managing Director of CGP Group, which specialises in recruitment and human resources, for the latest episode of Immigration Insights with Bartra Wealth Advisors. Watch the interview to understand what makes Ireland and its job market special and why would-be immigrants should consider it, particularly for their children’s future careers.

Fintech Evolution Centre

Ireland is rapidly transforming into a European tech hub with steady growth in employment driven by tech companies recruiting new talent. One of the country’s major tech sectors is fintech.

Many people may not be aware that Ireland is Europe’s leading financial centre, with half of the world’s top 50 banks boasting branches in Ireland and many financial service providers having relocated staff and operations to Ireland following Brexit. Ireland is also known as the “Silicon Valley of Europe” with global tech giants such as Apple, Microsoft, and Google all having set up European headquarters in Ireland. By taking advantage of the well-established financial services and technology sectors, which boast talent from the US, the UK and all over the world, the country has emerged as a growing international fintech hub providing great opportunities for graduates and young people.

Joe Morley, CEO for TrueLayer Ireland and GM Europe, commented that Ireland has become the EU’s fintech centre of choice for some of the top fintech companies in the world, including the likes of Coinbase, Stripe, Remitly and Square. With the recent boom in fintech, Ireland has successfully seized the opportunity and become a leading innovation hub for fintech’s key players.

Square, the financial services and digital payments group supported by the Irish Government through IDA Ireland, launched in Ireland in May 2021. As an NYSE-listed company, Square is just one of the many fintech companies that have huge confidence in Ireland and chose the country as the location for its new headquarters, demonstrating that Ireland is an excellent place to accelerate fintech development in the long run.

Minister of State at the Department of Finance of Ireland Sean Fleming said: “This rapidly growing sector offers exciting opportunities for experienced executives and graduates across the country and an environment in which they can thrive. The development of the fintech sector is one of my priorities in Ireland for finance strategy.”

These developments in Ireland have allowed experienced talent and graduates who are interested in working in finance and technology to exchange insights. Other than gaining a broader field of vision, graduates in Ireland can be exposed to worldwide fintech enthusiasts without going abroad as their hometown offers one of Europe’s most fintech-favourable environments.

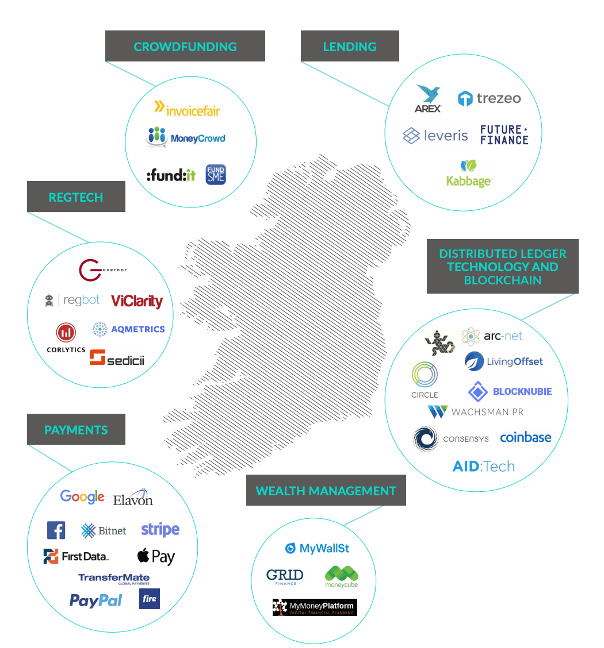

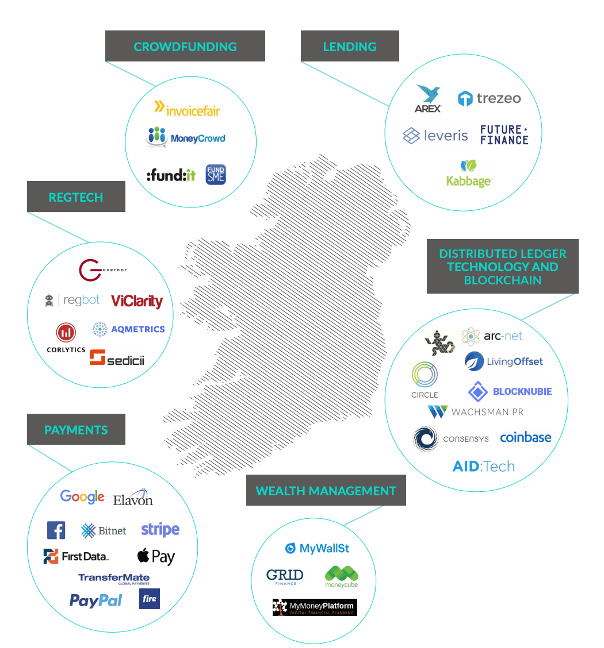

Rapidly-growing fintech start-ups that have set up their European headquarters in Ireland include:

- Stripe: Fintech unicorn with a $95B valuation as of March 2021; approaching “hectocorn” status

- Coinbase: The largest cryptocurrency exchange in the United States by trading volume as of March 2021

▲ A snapshot of the international fintech industry in Ireland (Source: A&L Goodbody)

4 Factors Kickstarting Fintech Breakthroughs in Ireland

Governmental factors

Known as a place where finance and technology come together, the Irish government is dedicated to cementing Ireland’s reputation as a hub for the fintech industry. In 2015, the Irish government launched IFS2020, a five-year strategy to develop Ireland’s International Financial Services sector.

IFS2020 identified three key actions to implement concerning fintech:

1. Enhance international financial services, and information and communications technology

2. Source funding for fintech

3. Support fintech accelerators through partnerships with Enterprise Ireland.

The above, coupled with the synergy created from collaboration with large multinational enterprises, has contributed to the employment of approximately 40,000 people in financial services and more than 100,000 in technology, and these numbers are only going to grow going forward.

Apart from fund sourcing, another key element of IFS2020 is the partnership with Enterprise Ireland, a governmental organisation responsible for the development and growth of Irish enterprises in world markets. It has a fintech team in Dublin that supports more than 220 companies with business strategies that are internationally focused.

With the aim of identifying worldwide business opportunities, Enterprise Ireland has embarked on the coordination of several fintech trade missions in the US, connecting European-based fintech start-ups with technical talent in North America. Immigrants in Ireland, especially those interested in fintech and its associated sectors such as crowdfunding and blockchain, have found this connection helpful, particularly when it comes to career development and capital flow home. Frequent capital flow fuels the further development of fintech through various means including knowledge research and nurturing talent.

Collaborative factors

The collaboration between fintech talent, world-class business, technology companies and research programmes has created advantages for Ireland that are allowing it to thrive in the fintech sector, which strengthens its position as a fintech hub in Europe.

Ireland is full of world-class talent; eight of the top 10 global software companies have European headquarters in the country. In terms of research and development, FinTech Fusion, a new fintech research programme in Ireland, has been a major catalyst in encouraging breakthroughs in payment (PayTech), regulation (RegTech), and insurance (InsureTech) technologies, according to Science Foundation Ireland. This has helped accelerate scientific progress and enable data-driven research for fintech people thereby helping to retain talent in the country.

FinTech Fusion’s research programme integrates businesses and technology across various dimensions, including AI, cloud computing and big data analytics. The programme’s academic researchers work together with companies such as Deutsche Börse, Fidelity Investments, Microsoft and Zurich, to develop fintech innovations that will have the potential to impact markets and individuals. This assists in worldwide talent acquisition and retention.

The strength of Ireland’s talent pool has had a long-term positive impact on the country’s culture, growth, and success by creating an engaged and committed workforce. It is also far-reaching. Few know that many US businessmen are Irish by descent. According to Irish America magazine, Irish-Americans control many of the most powerful companies in the US, such as Intel and Motorola, and leading Irish-American business figures have built connections between the two fintech centres, encouraging exclusive business partnerships.

Political factors

Ireland is a committed member of the European Union (EU). As a result of Brexit, a number of high-profile fintech companies have made plans to relocate to Ireland in order to continue business cooperation in the EU.

Following Brexit, there are greater barriers for capital transfer between the EU and the UK, which raise the cost of business partnerships for fintech start-ups and unicorns.

Legal factors

Under the Irish legal system, commercial disputes valued over €1 million can be dealt with through the fast-tracked Commercial Court, which is a division of the High Court. Ireland is also a ‘common law’ jurisdiction, similar to the UK and the US. Common law consists of a series of principles and rules developed by judges over many centuries. It involves courts deciding cases by following the principles laid down in earlier cases and written judgments. This operates in tandem with legislation introduced by the Government to regulate specific areas, such as the financial services, data protection, the environment and criminal law, but this legislation is always subject to judicial interpretation.

English speaking, pro-business and with an efficient Commercial Court, Ireland is positioned to take advantage of its status as a common law jurisdiction integrated into the EU, which further strengthens its position as a fintech hub.

Summary

Are you looking for the best place for your kids to create, explore and invent? With the proliferation and sustainability of fintech start-ups, Ireland offers you and your family the most innovative and secure residency.

Immigrating to Ireland is an optimal option for the next generation to explore diverse and promising career opportunities. Contact us now to begin the journey to a bright future for you and your family.