If you’re thinking about making the Emerald Isle your home, fáilte! There is plenty to get excited about when it comes to living in Ireland, but before you move, it’s important to ensure you and your family have adequate health insurance.

Some of the challenges that immigrants face when it comes to healthcare services include language barriers; difficulties in arranging care without medical insurance coverage; lack of familiarity with the healthcare system; cultural differences; divergent understanding of illness and treatment; negative attitudes among staff; and lack of access to medical histories.

In this article, we look at the healthcare and medical services available in Ireland and speak to an insurance expert to understand more about insurance planning prior to moving abroad, the types of insurance emigrants should keep or forgo when moving overseas, and the insurance policies that can be used for tax planning.

Ireland’s healthcare and medical services

Ireland offers high quality and advanced healthcare and medical services. For families and individuals immigrating to Ireland, there are various routes to accessing healthcare:

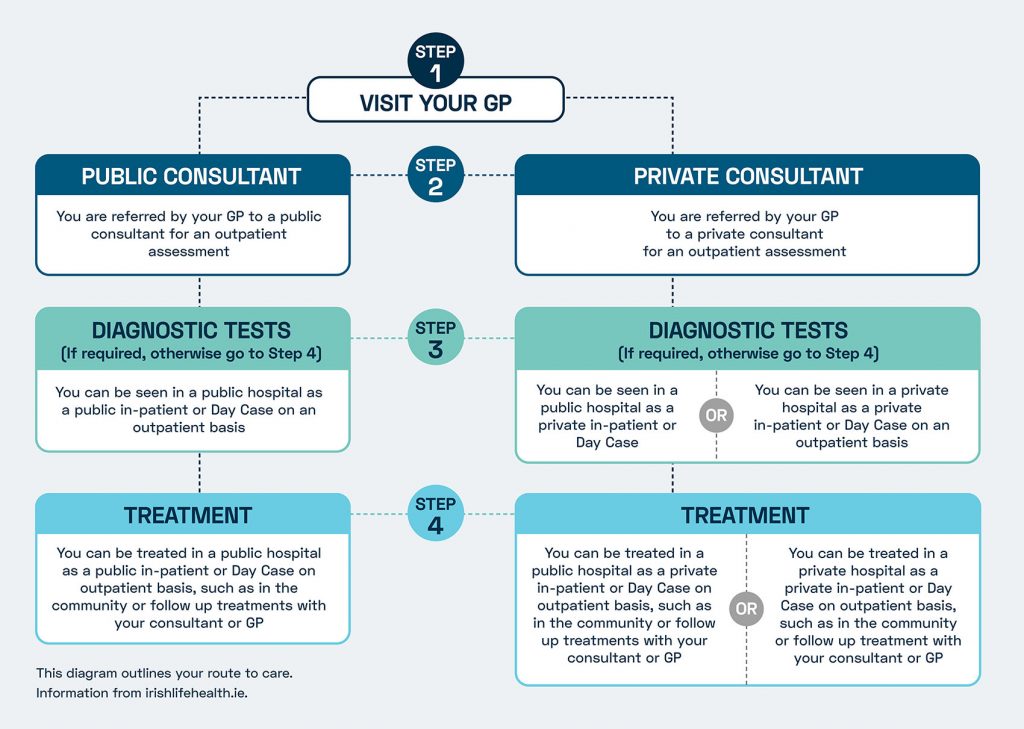

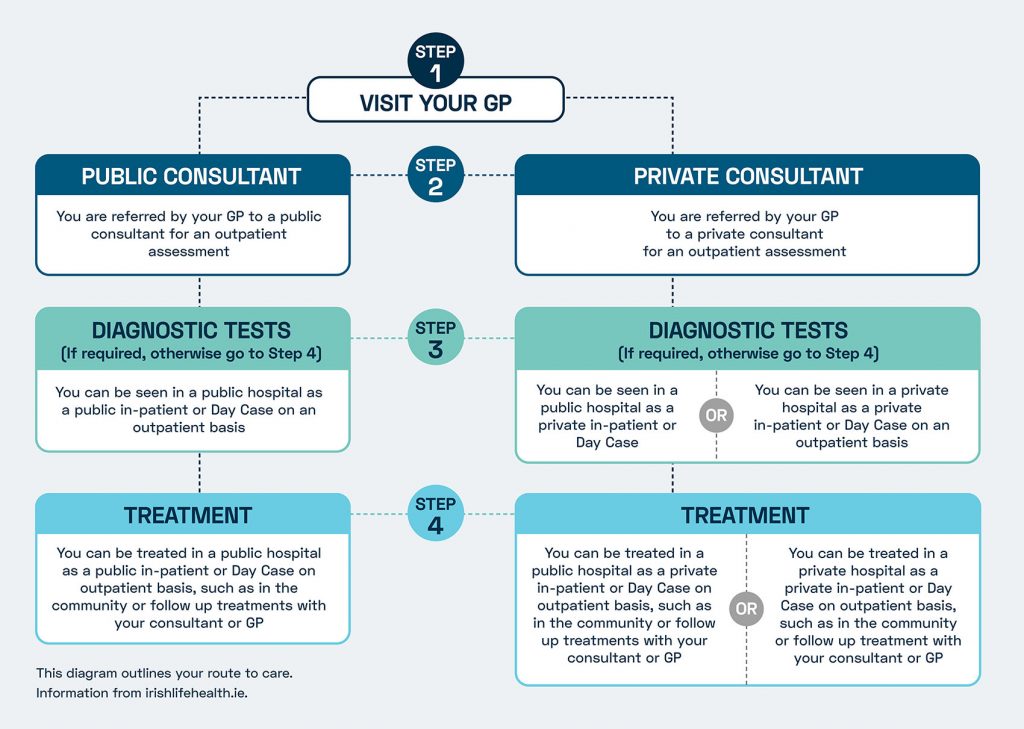

GP – Access to a doctor, or general practitioner – GP for short – is essential for general health issues and non-emergency illnesses. A list of local GPs can be found on the website of the Health Service Executive (HSE), and registration with a practice can be done by providing name, address and PPS number. Unless it’s an emergency, GPs are the gateway to the Irish hospital system. If you need any hospital service, your GP will usually refer you to the place or person you require. For example, if an X-ray, blood test, scan or other procedure is necessary, your GP will tell you where you should go. He or she will also provide you with a letter of referral. Similarly, your GP will refer you to a consultant if you need special expertise.

A&E – The Accident and Emergency department of a hospital, A&E for short, is where you go if you’ve had an accident or feel extremely unwell. Treatment is on a needs basis, so if the condition is not urgent the wait time may be extensive. There is a charge of €100 to attend without a GP referral.

Private Healthcare – If you are a private healthcare patient covered by health insurance, you may be eligible for a range of benefits. These include faster access to diagnostic investigations and subsequent treatments through your choice of consultant, and access to both public and private hospitals depending on your insurance plan (including high-tech hospitals). Treatment and services for private patients are provided by a wide network of private hospitals and clinics, as well as public hospitals.

Private hospitals are located across Ireland and offer some of the most technologically advanced healthcare treatment options. The best include:

The Hermitage Medical Clinic: Hermitage Clinic, part of Blackrock Health, is a 112-bed private hospital in Lucan, West Dublin. The specialised medical teams provide medical, surgical and advanced radiotherapy care to patients and are supported by the very latest medical technology. The most up-to-date radiology equipment is available including MRI, PET/CT, Nuclear Medicine, 64 slice CT, Mammography, Ultrasound, X-ray and Fluoroscopy. They also have a fully integrated RIS/PACs system.

Blackrock Clinic: Blackrock Clinic, part of Blackrock Health, is Ireland’s leading high-tech hospital, focused on developing and delivering the newest and most technologically advanced healthcare.

Since it opened in the mid-1980s, the Blackrock Clinic has been recognised by the Joint Commission International (JCI), which accredits only hospitals that raise safety and quality of care standards to the highest levels, and was one of the first hospitals in Ireland to attain this international recognition.

![]()

![]()

Beacon Hospital: Beacon Hospital is one of the most technologically advanced private hospitals in all of Europe. It has Ireland’s most advanced diagnostic equipment and an Emergency Department located in Dublin.

With over 300 Consultants and 1,700 medical professionals, Beacon Hospital operates as a full-service acute hospital. Treatment and services include orthopaedic surgery, heart surgery, neurosurgery, general surgery, comprehensive cancer care (medical oncology and radiation oncology), and general and emergency medical services.

Beacon Hospital has satellite locations in Dublin 8, Wexford, Mullingar and Drogheda.

Bon Secours Private Hospital: Established in 1951, Bon Secours Hospital is an independent acute care private hospital located in Glasnevin in North Dublin. The Bon Secours Hospital Dublin is part of the Bon Secours Health System, Ireland’s largest independent healthcare provider incorporating a network of four modern acute hospitals in Cork, Dublin, Galway and Tralee. The Health System also includes a Consultation Centre in Limerick and a Care Village in Cork.

St. Vincent’s Private hospital: One of the world’s leading hospitals providing front-line, acute, chronic and emergency care across over 50 different medical specialties, St. Vincent’s is the only integrated multi-hospital campus in Ireland. Its Emergency Department (ED) is the major referral centre for the region for patients with strokes and major trauma.

St. Vincent’s Private Hospital is part of the St. Vincent’s Healthcare Group (SVHG), the group also includes St. Vincent’s University Hospital and St Michael’s Hospital, Dun Laoghaire, Co Dublin.

Insurance planning

Ireland’s public healthcare system is highly regarded. It ranked 11th for the best healthcare in the world in a 2018 study published by The Lancet, placing 12 positions above the UK. It also boasts more hospital beds per person than the UK, according to the OECD.

However, Ireland’s public healthcare is not always free. And having health insurance to pay your medical and hospital expenses can provide peace of mind for you and your family. With health insurance, you can expect:

- more options to choose top class private hospitals in Ireland

- quicker access to necessary medical care

- treatment in hospitals as a private patient

The average annual cost of Irish health insurance paid by individual policyholders as of December 2021 was €1,470 for adults. While insurance is an additional expense, not having it could prove far more costly.

Families planning to relocate overseas may wonder if the insurance plans they have purchased in their home countries are still effective once they move, and whether life insurance can be an effective tax planning tool.

We spoke to Gigi Tsoi, District Director of Wealth Management and Protection, about the things to take into account regarding healthcare and insurance when moving abroad.

Medical and healthcare insurance is just one of five main categories of insurance to review when moving abroad. The others include life insurance, critical illness insurance, accident insurance or long-term disability coverage, and Investment-Linked Assurance Schemes (ILAS).

Gigi suggests that families first review their current medical insurance to understand any existing coverage and its suitability for the country they are moving to. If coverage is limited, she recommends families invest in a high-quality international health insurance plan to cover their medical needs. Such an insurance plan can be a lifeline in case something happens when they are abroad and they need to seek global medical treatment.

She also highlights how Inheritance Tax (IHT) can be offset with life insurance, or that people can avoid IHT being charged by putting the assets in trust.

Summary

For families moving overseas, residing in a country with a good healthcare system and access to medical care is important. The healthcare and medical system in Ireland is modern, safe and among the best in the world, making Ireland a great place to live, study, work and retire. When families have adequate insurance coverage, they will have peace of mind that they and their loved ones will be protected financially and enjoy a good quality of life in Ireland.