The announcement of the latest iBond, which is the seventh series issued since 2011, is open for subscription at 9 am on October 23, 2020. The three-year-long, HK$10 billion worth bonds promises to provide a steady source of income for everyday investors, but there are always alternatives among the safe investments. We know an investment option that offers not only an almost guaranteed rate of return but also a world-class permanent residency.

What are we talking about?

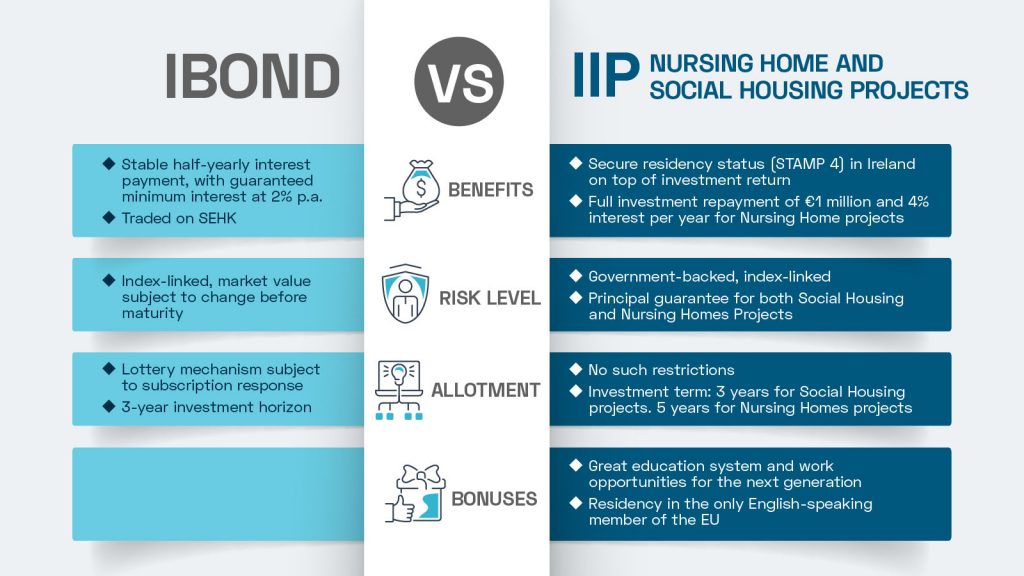

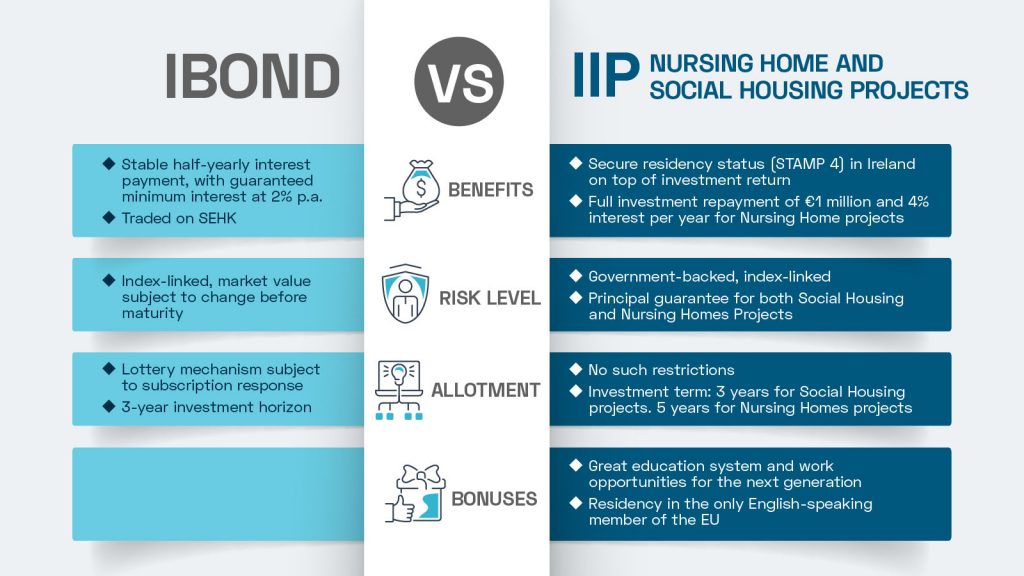

In short, the iBond is an inflation-linked retail bond released by the HKSAR Government under the retail bond issuance programme of the Government Bond Programme. Offered at a minimum denomination of HK$10,000, the HKSAR Government will repay 100% of the principal amount at maturity, along with generating half-yearly interest payments which are based on the Composite Consumer Price Index. The guaranteed minimum payment is at 2%.

If you are investing based on the appeal of a safe and regular return, investing in iBond is sensible. However, if you are aiming for more, the Immigrant Investor Programme (IIP) can be a promising alternative.

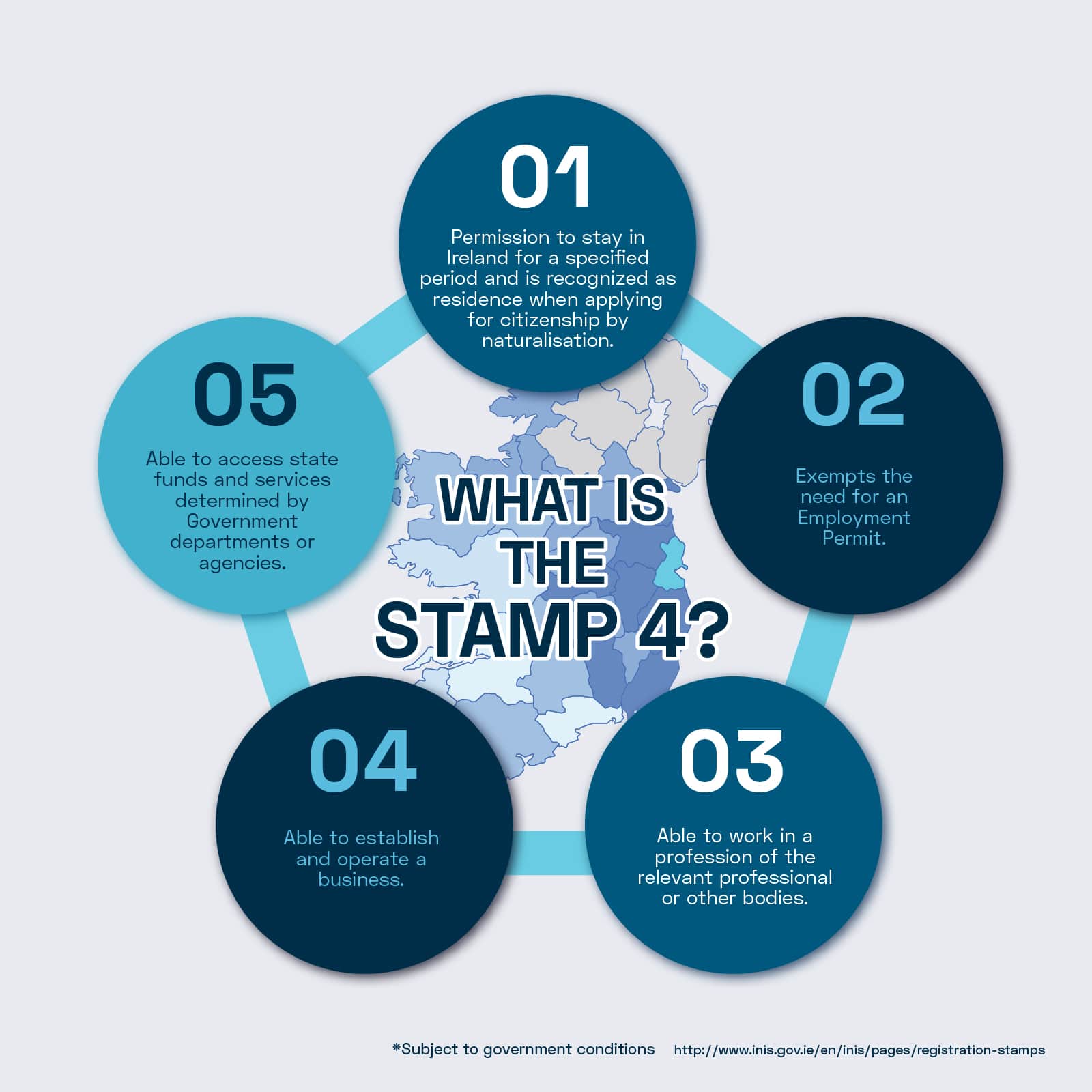

The Immigrant Investor Programme (IIP) offers the applicant a secure residency status in Ireland through an approved investment. Depending on the choice of project, whereby we offer government-backed Nursing Home and Social Housing projects under the Enterprise Investment route, the applicant will receive their full investment of €1 million and 4% interest per year if they were to choose to invest in our Nursing Home projects. This means, at the maturity of the five-year investment period, the applicant will get an extra €200,000 tax-free, on top of their €1 million investment, as well as a STAMP 4 identity in Ireland.

How do you invest in them?

The iBond subscription period will start from 9 am October 23 to 2 pm, November 5. Applications can be done via placing banks, securities brokers, or the Hong Kong Securities Clearing Company Limited. If the total application amount is under HK$15 billion, all eligible applicants will be satisfied. However, if the total application amount is over HK$15 billion, the iBond will be allotted by lottery, where each chosen applicant only gets one hand of bonds. The iBond will then be issued on November 16 and be listed on the Stock Exchange of Hong Kong on November 17. The trading of it in secondary markets can happen after.

On the other hand, the IIP is open for application at any time of the year and the process is very simple.

There are just four key steps to the IIP process:

- Application

- Approval

- Investment

- Receive residency

What is particularly attractive about this programme is that the investment is placed after receiving the approval letter. Not to mention, both of the assets of Social Housing and Nursing Home projects derive their income directly from the Irish State, making it a very safe investment for our investors.

Why should you care?

Both the iBond and the IIP are stable investments that offer promising investment returns. But as the intention to immigrate has spiked in recent years, being able to obtain a residency on top of an investment can be very appealing.

Ireland is an emerging emigrant destination for Hong Kong people. As the only English-speaking member of the European Union, Ireland is a gateway to both the UK and European countries, offering a great education system and enjoys one of the lowest corporate tax rates in Europe, increasing its appeal as a regional business hub for multinational corporations.

The time for getting approval for the IIP is only 4-6 months. There are no language requirements and the residency requirement is just one day per year, meaning that the applicant can obtain residency without moving.

The choice is yours

Of course, you should assess all the aspects of every investment you make, and there will definitely be variables that may change your mind. For example, the biggest barrier to the IIP is that the applicant is required to have €2 million net wealth. While we are able to offer investors a 4% annual investment return on their €1 million investment for 5 years, the iBond has historically exceeded the 2% minimum return, where their highest interest rate offered was 6.08% in 2011.

This is why we’re here. To find out more about IIP, how it works, what the benefits are, and how you can apply, speak with one of our expert advisors! Or simply complete the form below to download your IIP brochure.